MBC - Background Check Module

The Background Check Module transforms public data into risk intelligence, supporting audits, hiring, and strategic processes.

Contact us

WHAT IS

BACKGROUND

CHECK?

Background Check, also known as background screening, is the process of analyzing data and history of legal entities to confirm identities, validate information, and identify potential risks associated with new business, contractual, or institutional relationships.

This screening is performed through automated queries to public and private, national and international databases, revealing important data for secure and compliant decisions.

WHY IS BACKGROUND CHECK IMPORTANT?

t-Risk’s Background Check Module (MBC) directly contributes to the security, compliance, and credibility of business operations and is essential for:

Adopting background check routines represents a new culture of diligence and corporate responsibility. With automation technologies, artificial intelligence, and smart data matching, MBC enables the creation of complete and updated dossiers in minutes, supporting safer and more transparent decisions.

- Reduce reputational and legal risks

- Meet compliance and AML/CFT protocols (Anti-Money Laundering and Combating the Financing of Terrorism)

- Prevent fraud, corruption, and conflicts of interest

- Ensure KYC, KYS, and KYP practices (Know Your Client, Supplier, and Partner)

WHY PERFORM BACKGROUND CHECK?

-

Reduces risk and increases business safety. Prior verification of clients, suppliers, and partners helps identify irregularities, fraud, illicit activity involvement, and other risk factors that may compromise organizational reputation and results.

-

A competitive edge today — and a requirement tomorrow. In an increasingly regulated and compliance-sensitive market, automated background checks become a strategic advantage and a necessity to meet audits, regulators, and international standards.

-

Strengthens compliance culture and responsible decision-making. Including background checks in onboarding and relationship flows demonstrates a commitment to ethics, transparency, and responsibility in all relationships.

SMART BACKGROUND CHECK

The growing volume of data, the need for speed, and the complexity of risks in new relationships make manual background checks inefficient and vulnerable. The combination of Big Data and Artificial Intelligence allows hidden risks to be identified, critical information to be validated, and processes to be automated with precision and agility.

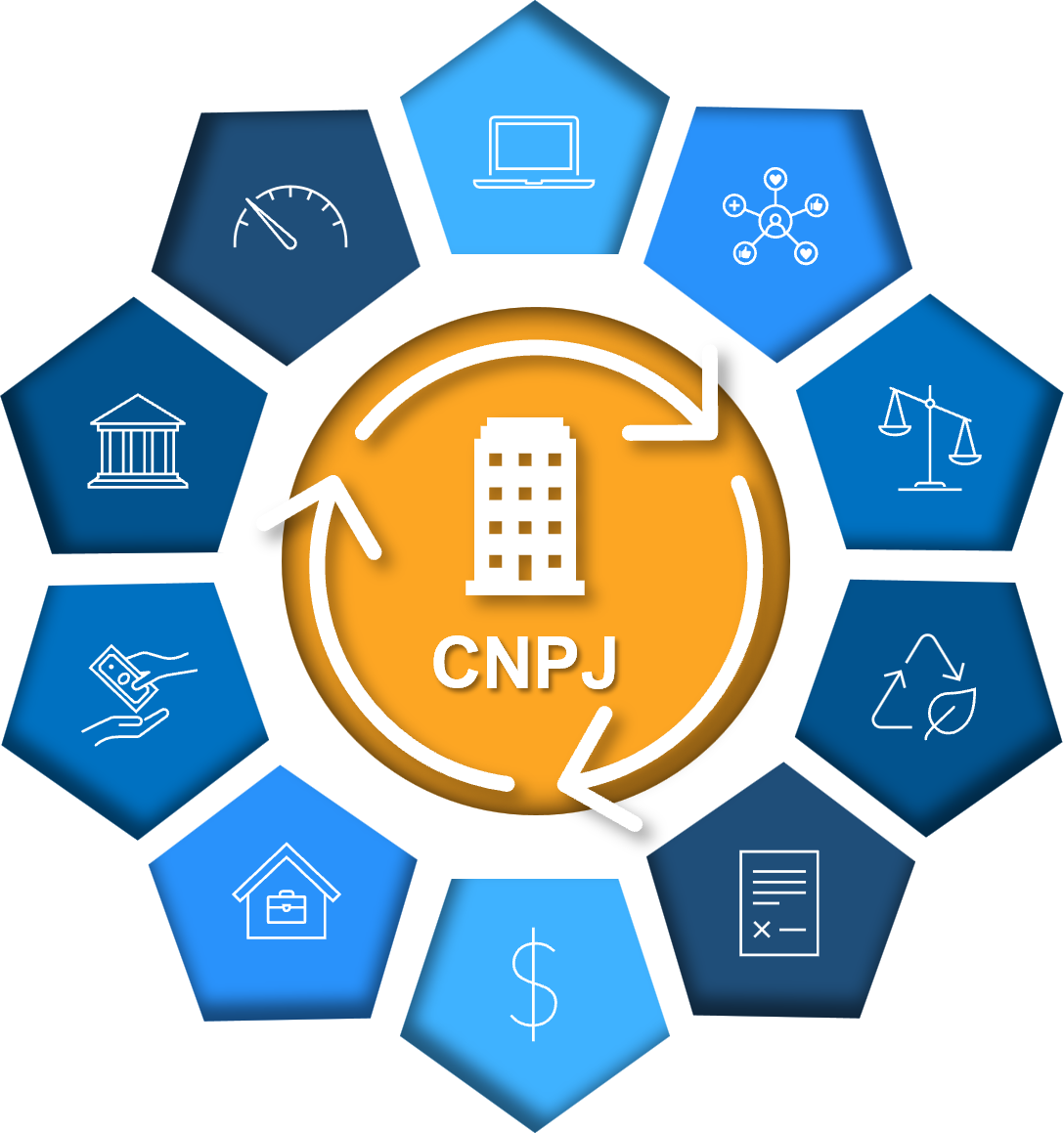

t-Risk’s MBC provides transparency, reliability, and speed in CNPJ analysis, generating complete dossiers in minutes. It strengthens compliance, onboarding, due diligence, and fraud prevention with actionable visual reports.

More than a report, MBC delivers decision-making intelligence so you can focus on what truly matters — avoiding risks, protecting your reputation, and building safer, sustainable relationships.

T-RISK’S BACKGROUND CHECK MODULE

BACKGROUND CHECK PROCESS WITH T-RISK MODULE

Much of this process is fully automated, enabling real-time, accurate analysis while saving time and resources. Regardless of your organization’s size or industry, adopting t-Risk’s MBC as a background check and digital due diligence tool ensures safer decisions, reduces reputational, legal, and financial risks, and strengthens your compliance culture.

SECURITY AND COMPLIANCE

MBC is t-Risk’s solution to transform the background check and digital due diligence process, enhancing security and intelligence in decisions involving legal entities. With advanced data collection and analysis technology, MBC enables faster, evidence-based decisions, reduces risks, and optimizes resources in tasks such as:

-

Real-time manual CNPJ verification

-

Comprehensive background checks for clients, suppliers, partners, and shareholders

-

Digital due diligence in hiring, M&A, and onboarding processes

-

Ongoing risk monitoring and automatic alerts for significant changes

-

Automated management reports with action plans, status, and deadlines using 5W2H

-

Interactive dashboards with risk and compliance indicators

-

Executive dossiers generated with a few clicks

-

Intuitive process from query to decision-making in one place

With MBC, t-Risk offers a new way to protect your organization, automating critical tasks with security, efficiency, and full compliance with the LGPD – Brazil’s General Data Protection Law.

MORE CONTROL AND FORESIGHT

Data-driven decisions to protect your organization from the start of a relationship. t-Risk’s MBC turns background checks into a strategic performance and protection tool, automating queries and data matching with intelligence and traceability.

Enhance compliance and anticipate legal risks. Avoid associations with CNPJs involved in lawsuits, tax issues, fines, or environmental and labor violations. Reduce exposure to sanctions and improve governance.

Implement preventive controls and customized action plans. Assign tasks, deadlines, and responsible parties directly from the reports. Monitor action progress with interactive dashboards and automatic data update alerts.

Make background checks part of your compliance and ESG strategy. MBC transforms scattered data into organizational intelligence, with reports aligned to sustainability, reputation, and business continuity goals. It becomes a proactive tool for prevention and competitiveness.

WHAT DOES MBC ANALYZE? LEGAL ENTITY

Risk classification based on GRI, SDGs, Ethos, Central Bank, SUSEP, and other standards

Links to economic groups under investigation or with significant legal liabilities

Suppliers or waste recipients under investigation for slave labor, fraud, or corruption

History of labor liabilities and use of irregular third-party labor

Federal, state, and municipal tax debts under collection or litigation

Company registration data, status, and tax information from Receita Federal

Complete corporate structure, including connections with individuals

Ongoing or completed lawsuits in civil, tax, environmental, and labor courts

Environmental infractions and embargoes from IBAMA and state agencies

Inclusion in national and international restricted lists such as CEIS, CNEP, and OFAC